Stock Advisor| Financial Planner |CFA charter holder|| Content Creator

For enquiries email at adityashah291@gmail.com

26 subscribed

26 subscribed

26 subscribed

26 subscribed

How to get URL link on X (Twitter) App

26 subscribed

26 subscribed

What has happened?

What has happened?

What are Equity Mutual Funds?

What are Equity Mutual Funds?

What is a Chartered Financial Analyst(CFA)?

What is a Chartered Financial Analyst(CFA)?

What is a super top-up policy?

What is a super top-up policy?

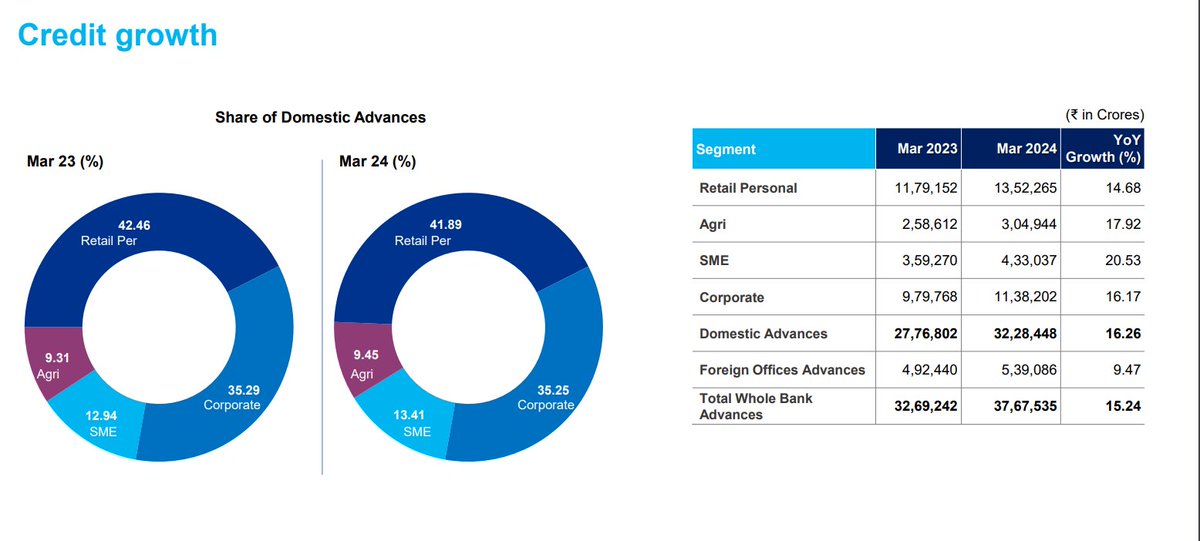

Credit Growth:-

Credit Growth:-

The banks that we will take for comparison

The banks that we will take for comparison

Loan Growth:-

Loan Growth:-

Health insurance is a very personal Experience

Health insurance is a very personal Experience

Loan growth:-

Loan growth:-

Loan+Deposit growth:-

Loan+Deposit growth:-

Advances+Deposit growth:-

Advances+Deposit growth:-

What is a Mutual fund fact sheet?

What is a Mutual fund fact sheet?

What Is Asset Allocation?

What Is Asset Allocation?

A mutual fund is a pool of money managed by a professional Fund Manager.

A mutual fund is a pool of money managed by a professional Fund Manager.

How big is India's Infra push?

How big is India's Infra push?

What had happened?

What had happened?

Buying a house:-

Buying a house:-

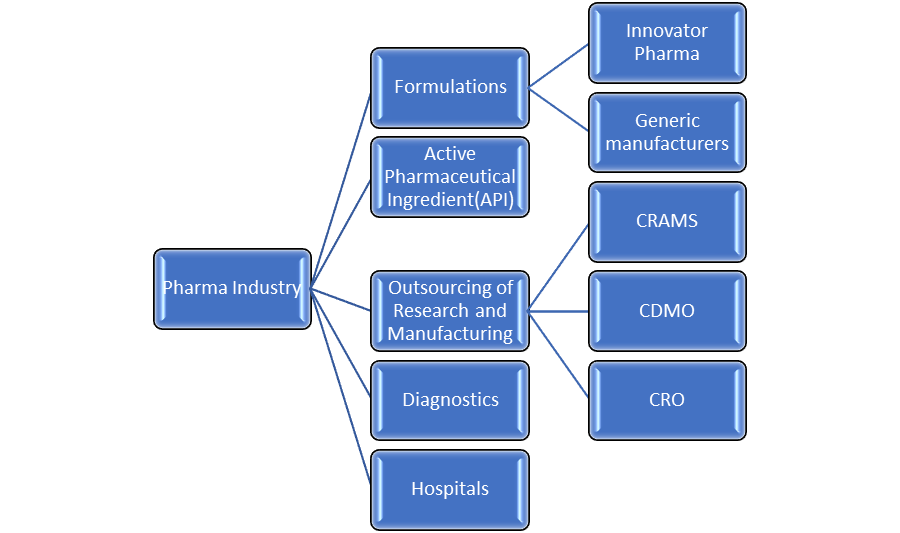

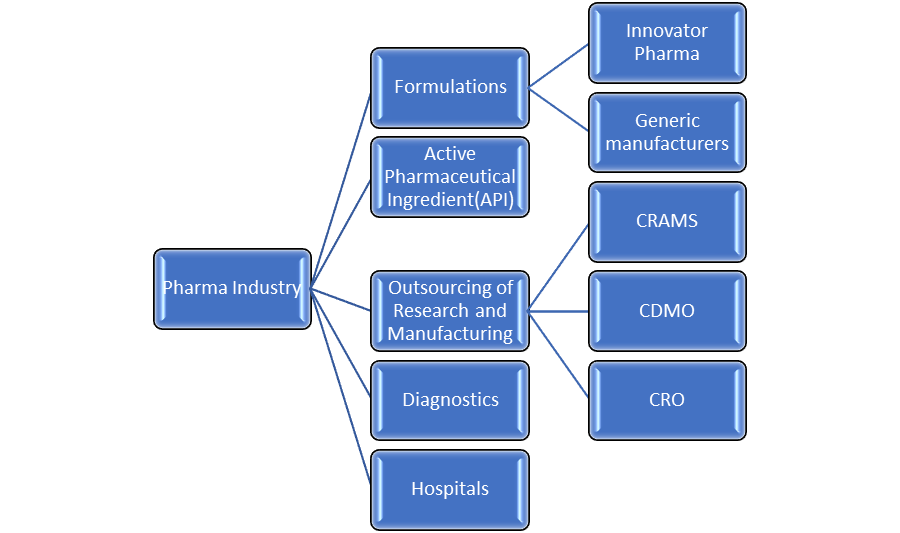

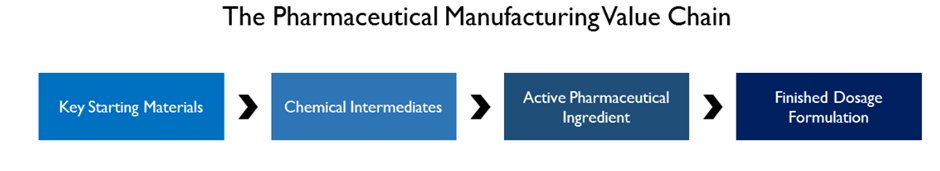

What is CRAMS/CDMO?

What is CRAMS/CDMO?

What is Hindu Undivided Family(HUF)?

What is Hindu Undivided Family(HUF)?

So how does the pharma sector operate?

So how does the pharma sector operate?

What are InvITs?

What are InvITs?